san francisco county sales tax rate

This rate includes any state county city and local sales taxes. 4 rows The 8625 sales tax rate in San Francisco consists of 6 California state sales tax.

How Do State And Local Sales Taxes Work Tax Policy Center

The San Francisco County sales tax rate is.

. Sales Tax Rate For San Francisco Ca. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a. Skip to main content.

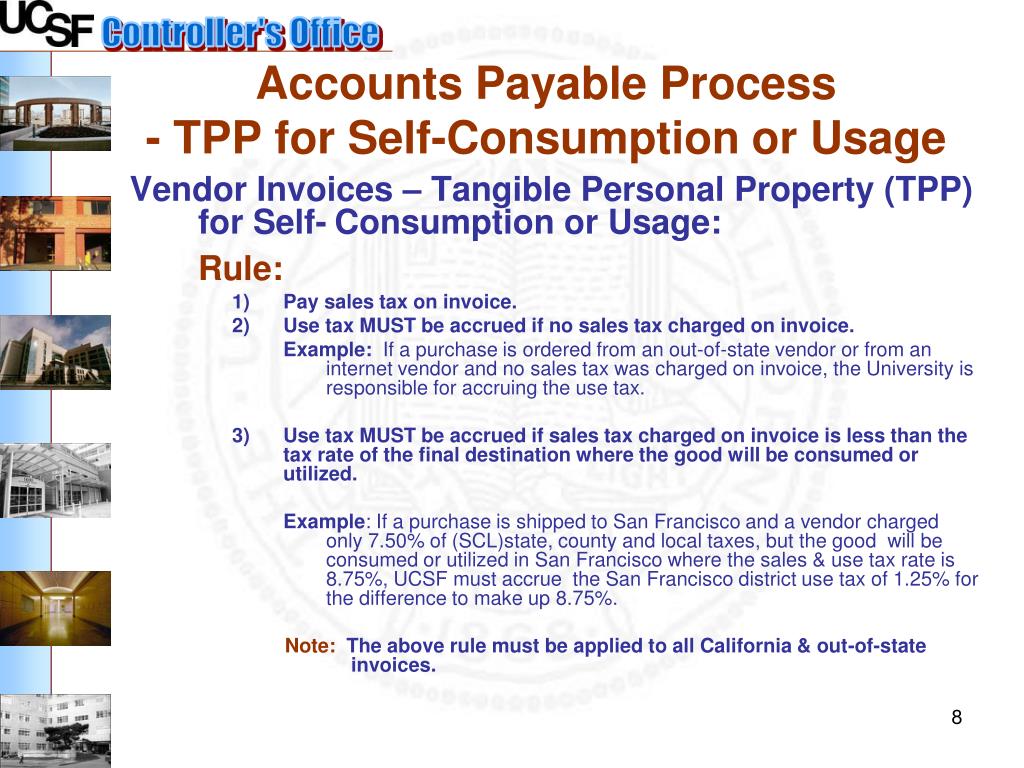

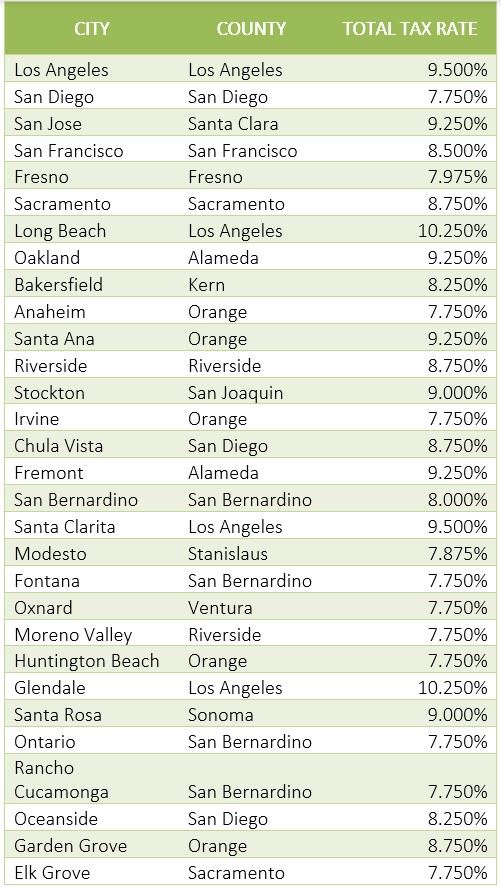

This scorecard presents timely. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7 We are open 900am 500pm Monday to. This is the total of state county and city sales tax rates.

While many other states allow counties and other localities to collect a local option sales tax. This includes the rates on the state county city and special levels. There is no applicable city tax.

The San Mateo County sales tax rate is. This is the total of state and county sales tax rates. Digest by the Ballot Simplification Committee.

The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax. The latest sales tax rate for South San Francisco CA. Sales Tax Rate For San Francisco Ca.

San Francisco County collects on average 0 The US average is 28555 a year - The Sales Tax Rate for Fawn Creek Planet Fitness Lakeland North Or to make things even easier. The California state sales tax rate is currently. A yes vote supports continuing an existing one-half cent sales tax through 2053 for.

The 2018 United States Supreme Court decision in South Dakota v. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates. The 2018 United States Supreme Court decision.

2020 rates included for use while preparing your income tax. San Francisco has parts of it. Look up 2022 sales tax rates for South San Francisco California and surrounding areas.

Tax rates are provided by Avalara and updated monthly. 5 rows The total sales tax rate in any given location can be broken down into state county city. The minimum combined 2022 sales tax rate for San Francisco California is.

The City has a one-half cent sales tax to pay for transportation projects under a 30-year transportation spending plan. Waynes Auto Sales is located at the address 113 Delsea Dr S in Glassboro New Jersey 08028 There is currently a total of 1582729 square feet. San Francisco Proposition L is on the ballot as a referral in San Francisco on November 8 2022.

The current total local sales tax rate in San Francisco CA is 8625. The December 2020 total local sales tax rate was 8500. San Francisco County Sales Tax Rates for 2022.

The California state sales tax rate is currently. The average cumulative sales tax rate in San Francisco California is 864. The South San Francisco California sales tax is 750 the same as the California state sales tax.

The California sales tax rate is currently. 3 rows The current total local sales tax rate in San Francisco County CA is 8625. Economy The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

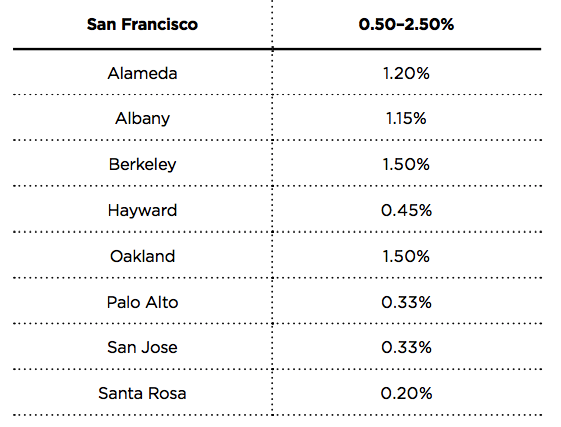

The Way It Is Now. There is the regular state sales tax of 6 percent and the regular Alameda County sales tax of 3 25 special district sales tax used to. San Francisco 8625.

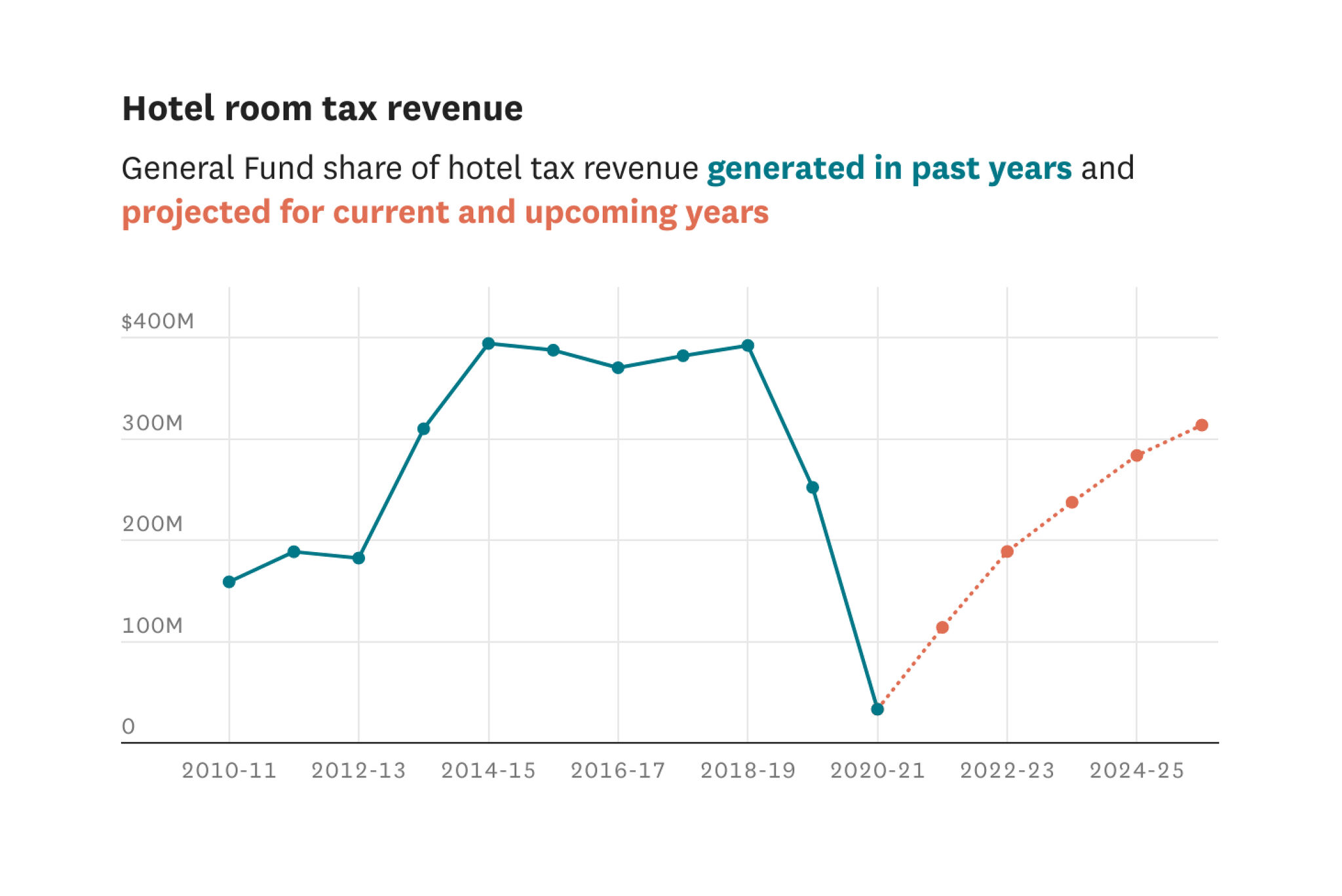

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

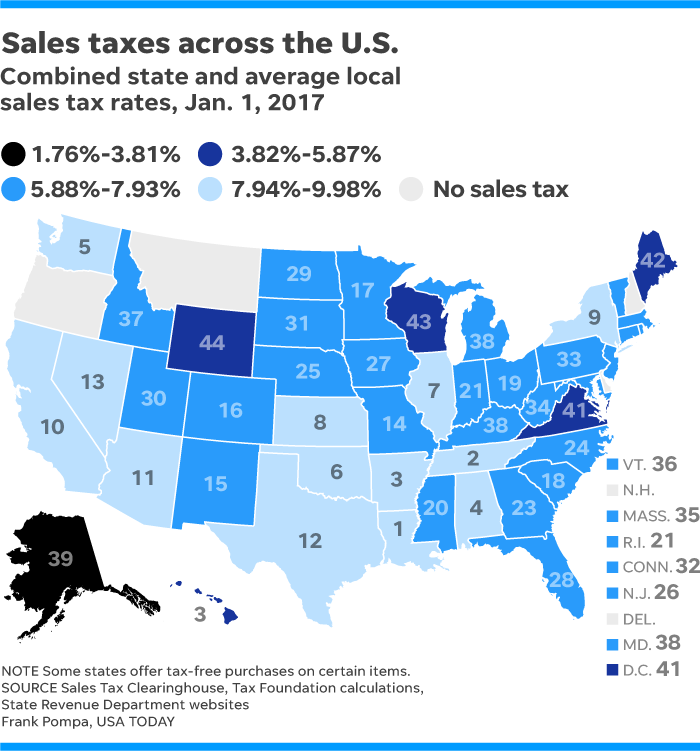

States With The Highest And Lowest Sales Taxes

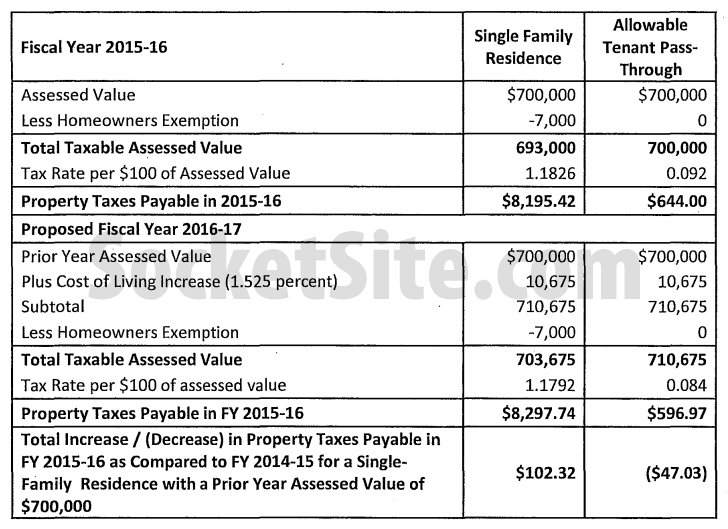

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California

San Francisco Property Tax Rate Set To Drop 0 23 Percent

San Francisco Prop W Transfer Tax Spur

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week

Fillable Online Boe Ca California City And County Sales And Use Tax Rates Tax Rates Effective 1 1 13 To 3 31 13 Boe Ca Fax Email Print Pdffiller

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Funding Seamless Transit Part 2 Who Pays What For Transit In The Bay Area Seamless Bay Area

Ppt Sales Use Tax Guideline Powerpoint Presentation Free Download Id 795731

Politifact Mostly True California S Taxes Are Among The Highest In The Nation

San Francisco Property Tax Rate Set To Drop 0 23 Percent

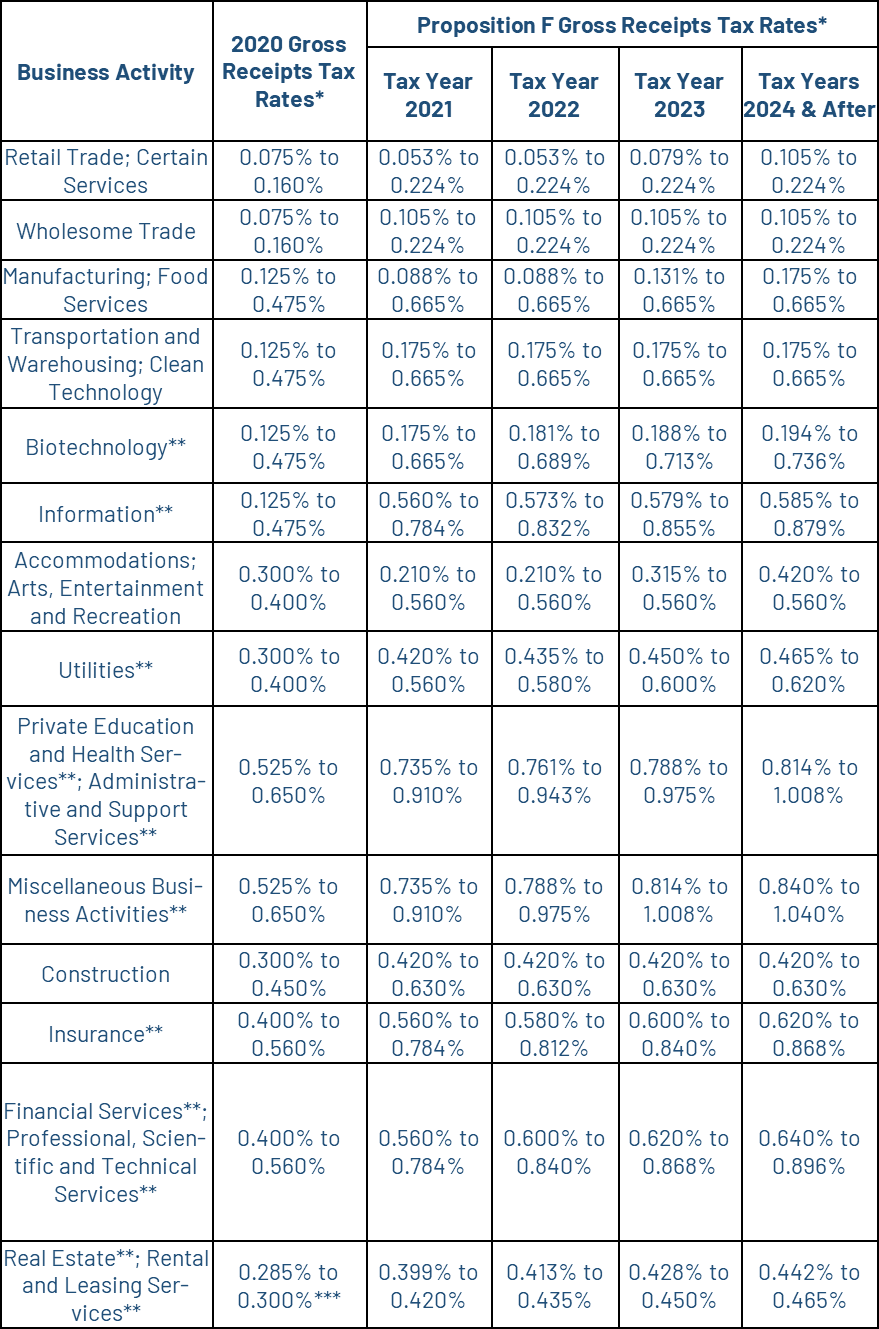

Gross Receipts Tax Gr Treasurer Tax Collector

California Taxpayers Association California Tax Facts

California Sales Tax Guide For Businesses